First, when making a futures trade, traders buy or sell contracts representing the value of a specific cryptocurrency. Definition of Futures Tradingįutures trading is similar to margin but different in a few key aspects. And if they believe the price will fall, they’ll short sell. If the price is expected to climb, traders will go long. In the case of protecting a portfolio via hedging with margin, traders can open a long or short position. Margin can be used to hedge against price and portfolio capitulations. However, when a margin trade goes unfavorably, they are required to answer what’s called a ‘ Margin Call ’, in which they must further invest margin or collateral into the position to avoid liquidation. This means that a margin position can remain open as long as a trader wishes, provided they have enough funds to keep their positions afloat. Then, the trader can select the leverage they wish to trade at.įor example, traders can open a margin position for $10,000 if the leverage ratio is 10:1, and in this case, the trader needs to invest only $1,000 as collateral.Īnother key aspect of margin trading is the ability to trade in perpetuity. Opening a margin trade first demands the investor to provide some amount of collateral.

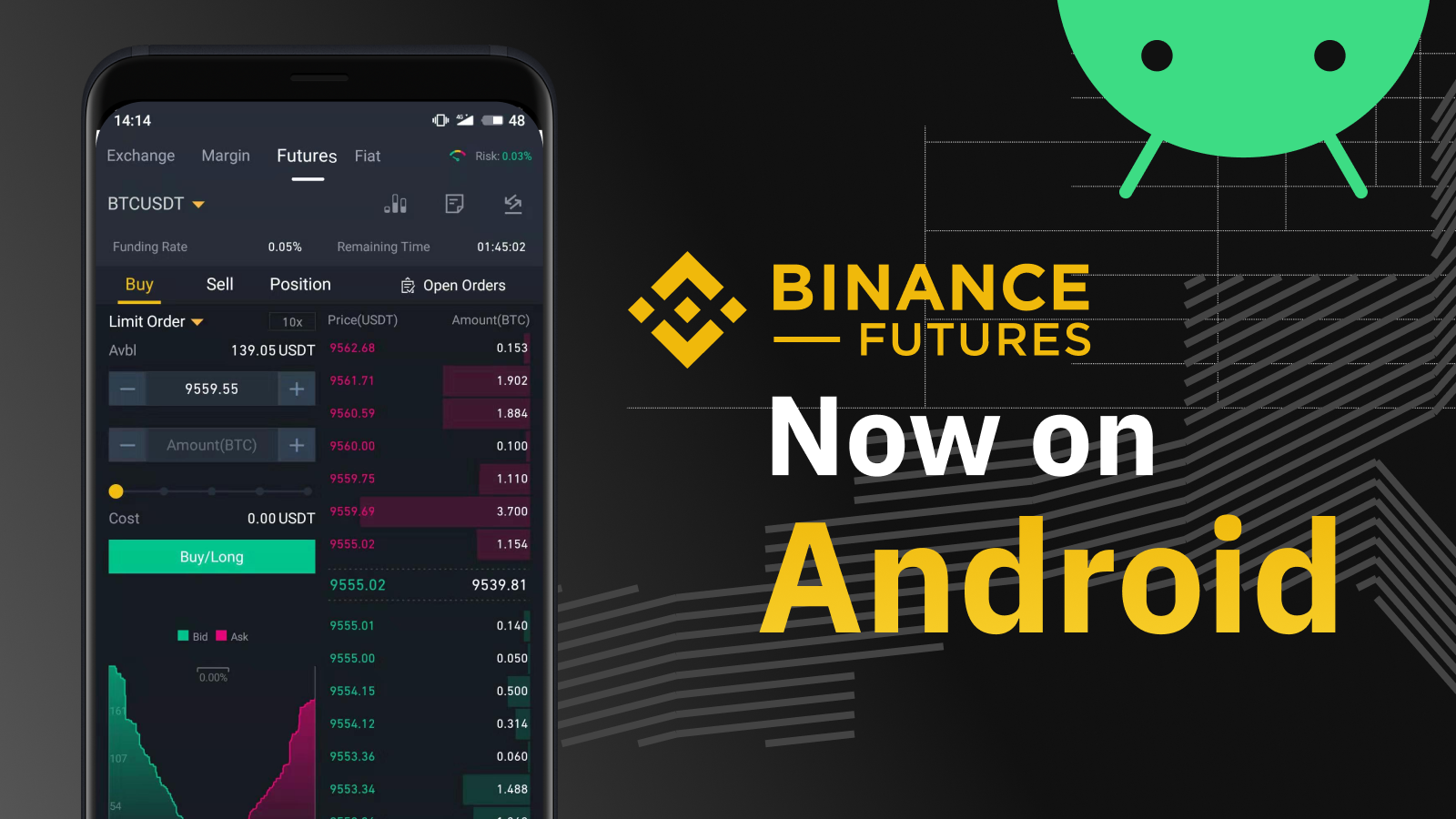

The funds that were borrowed, in turn, earn interest for the lenders at a rate based on market demand. Using these borrowed funds offer a bigger exposure to cryptocurrencies, which is known as using leverage. Margin accounts first separate from spot accounts by allowing users to borrow funds. The difference is that margin trades hinge on the use of borrowed funds to further capitalize on the future price movements of an underlying asset. This form of trading is similar to spot trading, in that margin trading directly involves trading a digital assets such as Bitcoin or BNB. Margin trading is a form of trading that is based entirely on the performance speculation of an asset. So, if both trading techniques do similar things, what are the differences between margin and futures trading? Definition of Margin Trading But with great rewards lies great risk, and both can easily become costly. Both instruments allow traders to potentially multiply their gains in bull or bear markets. Luckily, there are two ways to capitalize on such a situation.īinance Futures offers a different type of trading in the form of margin and crypto derivative contracts.

#Binance futures trading how to#

Maybe you feel as though you understand how to read the market well and have good intuition about price volatility. Prices of margin pairs are similar to spot prices, while futures prices consist of the futures’ basis, which may fluctuate according to changes in supply and demand, opening up opportunities for arbitrage.Īs the crypto markets continue to fluctuate and folks online continue to speculate over where Ethereum, Bitcoin, or BNB will trend towards in the following days, perhaps the possibility of attempting trades beyond the spot markets has crossed your mind. Meanwhile, quarterly futures contracts incur no fees and are ideal for long-term holders.

Margin trading will incur daily expenses which add up over time. Such pairs allow traders to speculate the relative performance of two cryptocurrencies in contrast to speculating on the direction of only one. Margin trading offers access to exotic trading pairs such as ADA/ETH or BTC/ETH.

0 kommentar(er)

0 kommentar(er)